Real Estate Agent Resources

Why order a MyFloodStatus Report for every real estate transaction?

Superior Accuracy, Structure-Based

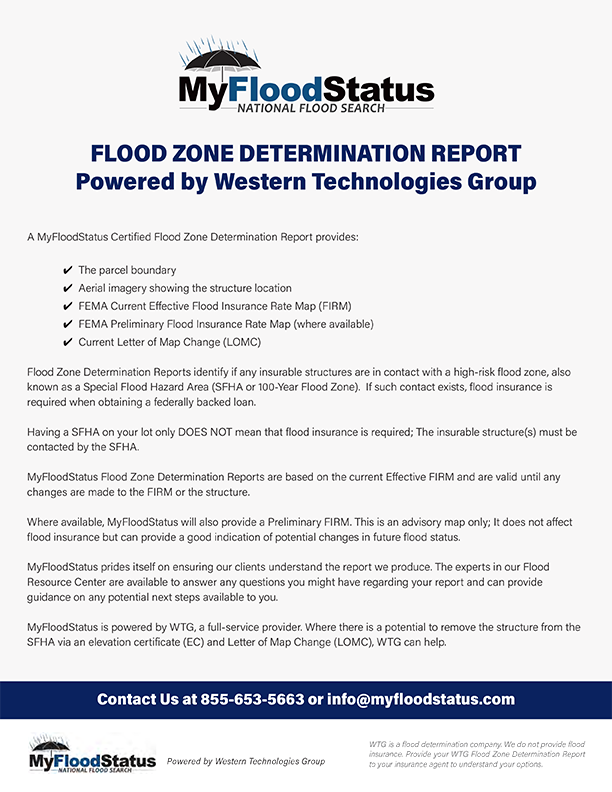

Having precise data on structure and flood zone locations is key to knowing your true flood status. Flood Insurance is required on a federally-backed loan for any structure that touches a Special Flood Hazard Area (SFHA), according to NFIP Guidelines.

Detailed Visual Verification Maps

You need and deserve greater clarity than “In” vs. “Out”. We surpass industry standards by delivering precise, accurate mapping detail of a structure’s location based on FEMA’s current, effective FIRM map, and Preliminary FIRM if existing.

Expert Support and Protection

Every MyFloodStatus Flood Zone Certificate is insured with $3M Error & Omission, removing liability from you, the Real Estate Agent. Our team will explain report findings and provide expert guidance in subsequent mitigation efforts.

Sign up for GOLD

Our GOLD Membership subscription-style program provides convenience and big savings to Real Estate Professionals. Add our premier reports to all of your listings to deliver elite service to your clients.

FREE Agent Resources

Click the images below to view, download or save.

Frequently Asked Questions

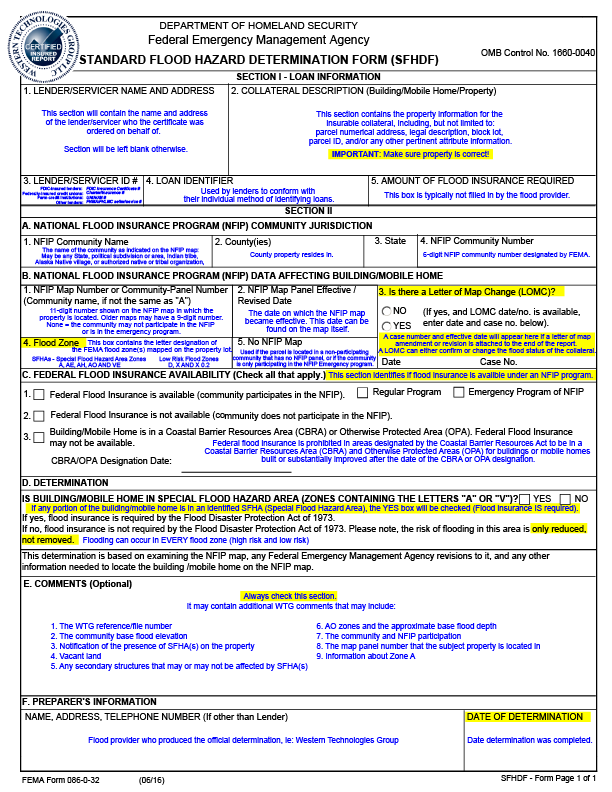

What is a flood determination report?

A flood determination, often referred to as a flood certificate, provides information about a specific property or structure with relation to flood zones, including Special Flood Hazard Areas. The primary document in a flood report is the Standard Flood Hazard Determinatioin Form, or SFHDF. Our reports to deliver superior precision and clarity, visual verification maps that show you where the flood zones are compared to your property boundary or structures, and unparalleled support.

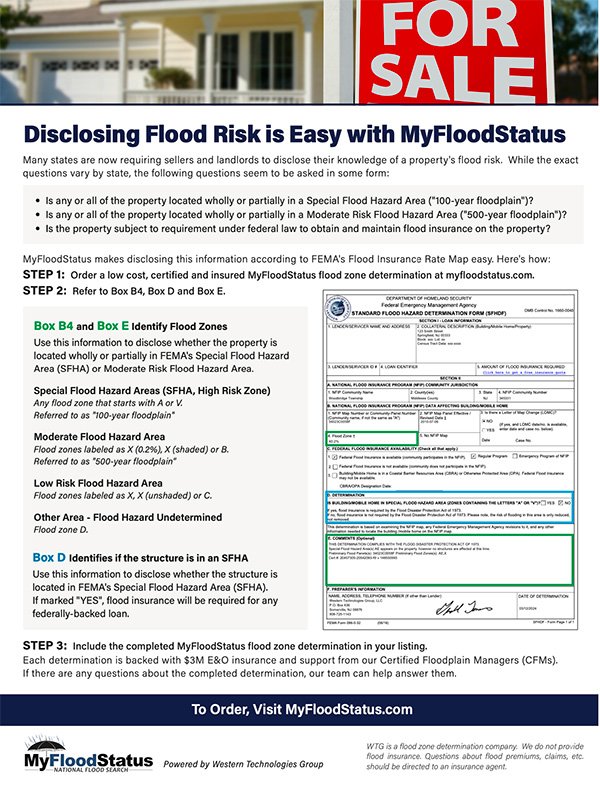

Can I use a flood determination to challenge my current flood status?

Yes. In fact, thousands of properties nationwide have been previously mis-identified. Moreover, new FEMA maps are being released each year which can render old determinations useless. A WTG flood determination report will confirm the true flood status of any property, and include both a current and preliminary map. Our experts can advise on opportunities to challenge your current flood status by securing an Elevation Certifiicate or a Letter of Map Amendment.

Can you help remove a mandatory flood insurance requirement?

This process always starts by ordering a flood zone determination report to confirm if your structure is within a Special Flood Hazard Area, or has the potential to be removed by ordering an Elevation Certificate or Letter of Map Amendment. Our experts can then consult, advise and guide you through the process.

Are your flood determination reports insured?

Yes, WTG’s flood determination reports are insured for Errors & Omission to $3,000,000 per event.

If a high-risk zone touches my property, but not my home, do I need flood insurance?

National Flood Insurance Program (NFIP) guidelines only refer to the structure location in relation to the high-risk zone. If your property touches a high-risk zone, but your structure does not, flood insurance is not required under NFIP. This is why the precision of our reports is so important.

Why are WTG flood determinations better than other available resources?

We offer a particularly exceptional and accurate report, thanks to superior technology, mapping assets and expert analysis that has raised the bar in the industry. Our reports are pinpoint accurate, certified and insured, complete with visual verification maps utilizing both current FEMA maps as well as preliminary maps.

Are you using the new maps for your flood determination reports?

The idea of “new” vs. “old” maps is a misconception. There are current maps, called “effective” maps that we use for our determinations. Then there are “preliminary” maps designed to give a glimpse at the future, but not to be used as the basis for an official flood determination.

Can you help me understand my report and my options?

Aboslutely. We pride ourselves on offering detailed personalized service that you won’t find at any “big box” flood providers. Our trained experts are here to examine your reports personally, advise and guide you on any opportunities we see to challenge your flood status.