What Does The Term “100-Year Flood” Mean?

The floodplain: A system for evaluating risk

IN THE 1960’s, the US government created the National Flood Insurance Program (NFIP) and identified the floodplain as a system for evaluating levels of risk to home-owners’ properties. The floodplain is used to institute guidelines or requirements for flood insurance coverage.

Within areas that are at risk for flooding, there are different levels. For example, properties right on a waterfront are more likely to flood than those farther away. In certain areas, properties at lower elevation may be at greater risk to flooding than those more elevated.

The “1-percent annual chance flood” means there is a 1-in-100 chance of flooding in any given year. Commonly referred to as the 100-year flood zone or base flood, this is the standard measure for flood insurance requirement.

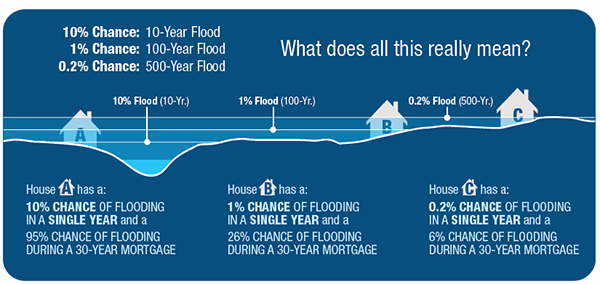

Based on which flood zone you are in, you could experience these chances of flooding in each single year over the span of a 30-year mortgage:

95% chance of flooding (10-year flood zone)

71% chance of flooding (25-year flood zone)

45% chance of flooding (50-year flood zone)

26% chance of flooding (100-year flood zone)

6% chance of flooding (500-year flood zone)*

Common misconceptions about the 100-year flood

MYTH

The most common misinterpretation of the 100-year flood zone is that it means your chances of experiencing a flood is once in every 100 years. However, this is incorrect.

TRUTH

A property in a 100-year flood zone has a 1% chance of flooding in any given year, which also means it can flood more than once within a 100-year period, and more than once in the same year.

MYTH

People may reason that if their property has not flooded within the past 100 years, that they can’t possibly be in a 100-year flood zone. However, this is an incorrect application of this statistic.

TRUTH

Statistical averages based on past precipitation records give us information, but not guarantees. Nature can be unpredictable, so we adhere to key statistics and best practices. Read on!

How the “flood zones” are represented on FEMA maps

High-risk flood areas identified on FEMA’s Flood Insurance Rate Maps (FIRMs) as Special Flood Hazard Areas (SFHAs).

SFHAs are defined as the areas that will be inundated by the flood event having a 1-percent chance of being equaled or exceeded in any given year. As we just covered, the 1-percent annual chance flood is the “100-year flood” zone.

On the FIRMs, SFHAs are additionally labeled as any zones containing the letters “A” or “V”.

Structure-specific location is a guiding factor

NFIP flood insurance requirements state that federally-backed lenders must require flood insurance on any habitable structure that comes in contact with a Special Flood Hazard Area (SFHA). The flood insurance levels of risk and coverage are "structure-based”.

FEMA FIRMs dictate who is required to carry flood insurance, based on the location of their structure and whether it comes in contact with the SFHA. This is why it’s important to secure a Flood Zone Determination Report that is also "structure-based", i.e. produced with precise data on structure location, and accompanied by highly-detailed visual maps and expert evaluation.

Elevation is a key aspect to take into consideration as well, which is why at times an Elevation Certificate can help certain property owners decrease or eliminate flood insurance rates.

Key takeaways

Flood risk can and does change over time, so it’s also important to refer to a comprehensive analysis of where your structure sits in relation to the Special Flood Hazard Areas, as indicated by FEMA’s Flood Insurance Rate Maps (FIRMs).

Don’t ignore flood insurance if you are in an area that is not considered an SFHA. You should always consider flood insurance. After all, FEMA states that 25-30% of all flood insurance claims are paid in areas outside of the SFHA High-Risk Flood Zones.

Moreover, FEMA maps and Risk Rating will continue changing flood statuses all over the country. Affecting tens of thousands of property owners. The simplest way to be protected is to confirm your true flood status with a low-cost MyFloodStatus Flood Zone Determination Report.

*Indicates statistical chances of flooding in EACH single year over the span of a 30-year mortgage.

The information provided in our site and blog posts is for informative purposes only and is not intended to be legal advice or a legal opinion. For legal advice, please consult an attorney.